Yesterday morning, I was filled with joy. My calendar was gloriously empty, which meant I could finally tackle one of those projects that demand a lot of focus. I would quickly pay a bill, then I’d get started. Two hours later, I was resolving to throw all my devices in a passing refuse truck. That two-minute job had involved installing apps, repeatedly entering the same information, and “talking” to a chatbot that kept timing out.

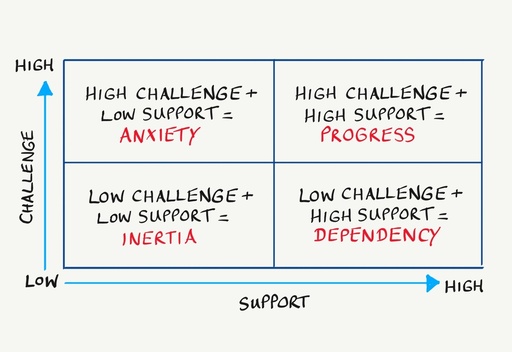

Once I’d calmed down, this unedifying episode made me think of the Support-Challenge matrix from John Blakey and Ian Day’s book Challenging Coaching. If we’re lacking both challenge and support, we get stuck. If there’s support but little challenge, we become dependent. With big challenges and low support, anxiety reigns. The sweetspot is high challenge with correspondingly high support. That’s where we make progress.

This model suggests what’s wrong with personal finance. While we’re awash with innovative ways of managing our money, the support is miserably low. Challenges abound, with confusing small print and increasingly complex authentication systems. The problem is even more serious when it comes to life-changing decisions, such as choosing a pension or mortgage. If you want to actually speak to a human, it can cost thousands of pounds. Unless, of course, you’re happy for them to sell you a product on which they’re receiving a sizeable commission.

The so-called “pension freedoms” introduced in 2015 are a prime example of low support, high challenge. Instead of rules to ensure we get a regular income during retirement, we’re now “free” to spend or invest that big pot of money as we please. With the exception of a few perverts like me, nobody actually wants to spend time thinking about a pension. What we want is a way of supporting ourselves in later life. Given most of us struggle to make long-term decisions, this is a highly challenging situation. That means we need a highly supportive environment that provides personalised and impartial advice. Otherwise, we’re liberated, but not empowered.

In the absence of a government willing to confront these issues, I’m wondering how we can get better support for these challenges. One change I’ve made recently is to switch to a bank with a proper branch network. In the time it took me to pay that bill yesterday, I could’ve resolved the issue in person and made progress on my project. The “convenience” of online banking is a myth. I’m keen to find out how we can reintroduce people and accountability, so there’s more support when dealing with inevitable challenges. How can we make money human again?

This post is part of the Tiny Experiments series.